Beginning in late Spring of 2020, Nebraska Early Childhood Collaborative (NECC), partnered with First Children’s Finance (FCF) to report on the access to capital for child care businesses in Nebraska.

Child care businesses often struggle to support themselves financially through traditional funding sources. This became exceptionally apparent during the height of the COVID-19 pandemic. While the Paycheck Protection Program was created to distribute emergency relief funding to businesses, many child care providers in Nebraska did not apply or weren’t successful in their applications to receive the emergency funding.

First Children’s Finance worked with NECC from Fall 2020 to Spring 2021 to map the capital landscape for child care entrepreneurs throughout Nebraska to determine what capital was available, who knew about it, and who was successful in accessing it.

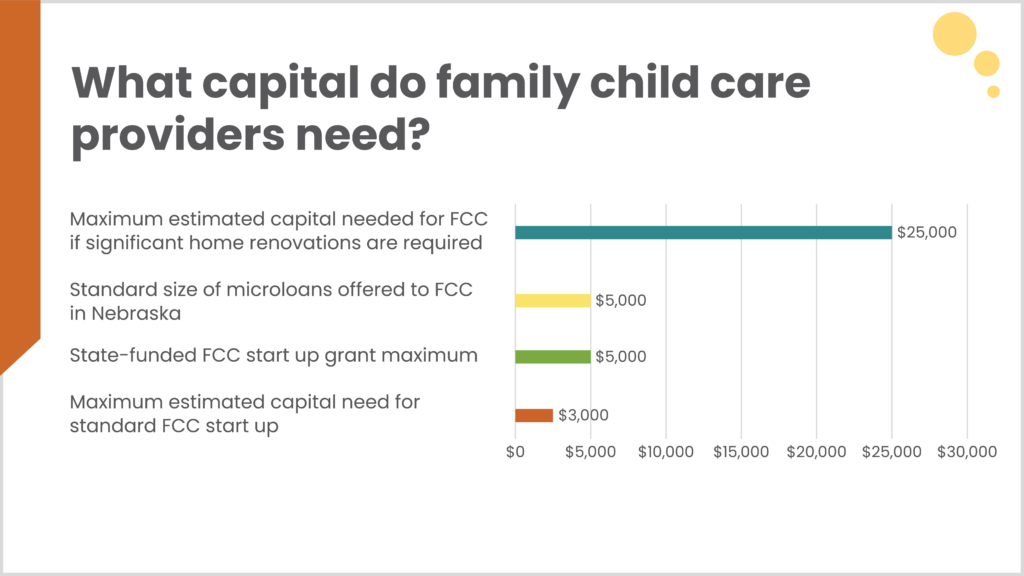

The report confirmed several assumptions, such as family child care owners withdrawing their 401ks, family savings, or maxing out credit cards to fund their business startup. It also provided an in-depth perspective on the shared need for knowledge and relationship building among family child care, center-based child care, and traditional financial institutions. It consulted more than 50 stakeholders representing child care business owners, banks, economic development agencies, nonprofit organizations, foundations, state administrators, ECE regional coordinators, and community leaders in the report to uncover several challenges preventing crucial access to capital for child care centers and providers.

Armed with these findings and recommendations provided by FCF, NECC will use this report to execute a strategy focused on their goal of ensuring equitable access to capital for child care businesses, including reducing the number of businesses that close due to financial crisis.

“With this new information in hand, NECC is focused on how we can be part of the solution to creating equitable access to capital for child care entrepreneurs. It is both an important and necessary step to begin to solve the child care crisis we are facing in Nebraska and across the nation,” said Shannon Cotsoradis, CEO of NECC. “Child care entrepreneurs need access to financial resources just like any other small business to get started or to expand their operations. And, given the challenges families are facing in finding child care, that is what we need them to do.”

NECC’s plan will include the development of community resources in partnership with local lenders to assist in bridging the gap between these vital small businesses and the critical funding that impacts community child care.

“This landscape analysis has shed light on the assumptions and the unknowns that child care businesses face when seeking the critical financial resources needed to launch, sustain, or grow their businesses. FCF is excited to see NECC take the findings and recommendations for this work and develop innovative strategies to help child care businesses navigate the complexities of accessing capital that works for them,” said Molly Sullivan, Director of National Initiatives at FCF. “Nebraska needs high-quality, sustainable child care business and NECC is going to continue innovating to make this happen. The findings will impact not only NECC, but hopefully their partners and collaborators throughout the state to positively change the opportunities that child care entrepreneurs have to access capital.”

About First Children’s Finance

Founded in 1991, First Children’s Finance addresses the business and finance needs of child care in three different ways: building the financial sustainability of child care entrepreneurs, partnering with communities to preserve and grow their child care supply, and influencing state and federal systems to provide supports and investments needed to sustain child care businesses. For additional information, contact Molly Sullivan, Director of National Initiatives.